Calendar Spread Strategy – A calendar spread, as the name suggests is a spread strategy wherein you trade on the gap between two similar contracts rather than betting on the price. This is considered to be relatively low . The long put calendar spread is a strategy designed to profit from a near-total coma in the underlying shares. Employing two different put options spread across two calendar months — with a .

Calendar Spread Strategy

Source : www.investopedia.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

4 Leg Calendar Spread | With Backtesting | Derive Trading YouTube

Source : www.youtube.com

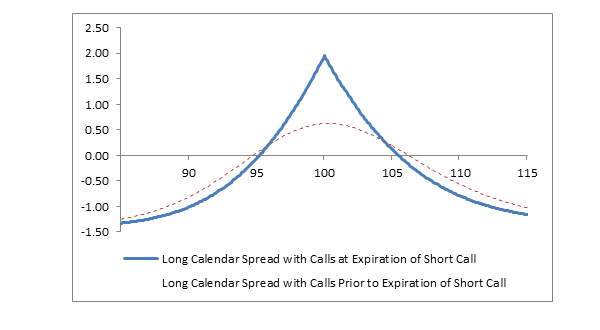

Long Calendar Spread with Calls Fidelity

Source : www.fidelity.com

The Poor Man’s Covered Call (and other Calendar Spreads) : r

Source : www.reddit.com

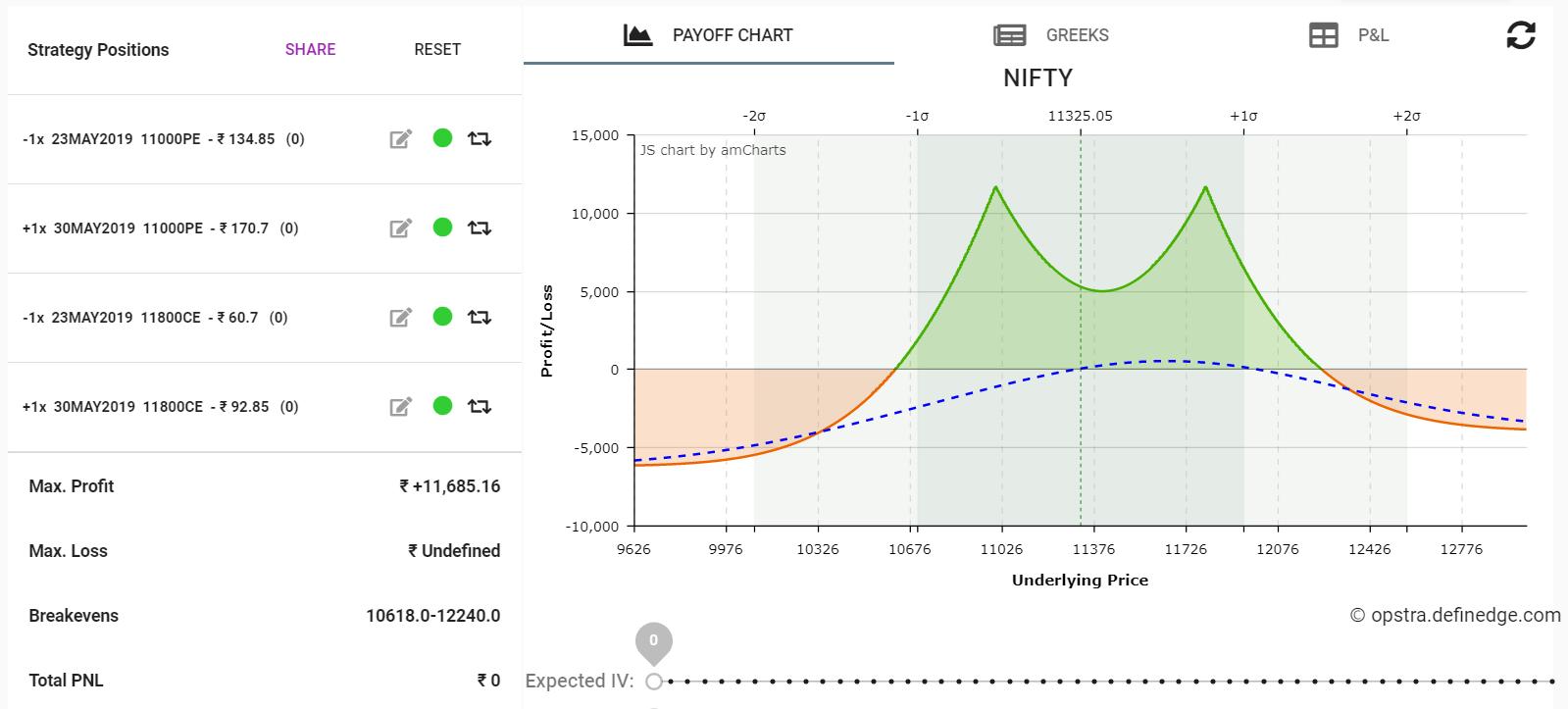

Raghunath on X: “Here is my election trade on #Nifty a double

Source : twitter.com

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

Calendar Spread Options Trading Strategy In Python

Source : blog.quantinsti.com

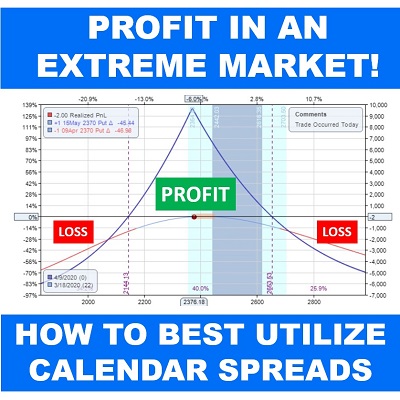

How To Best Utilize Calendar Spreads Locke In Your Success

Source : www.lockeinyoursuccess.com

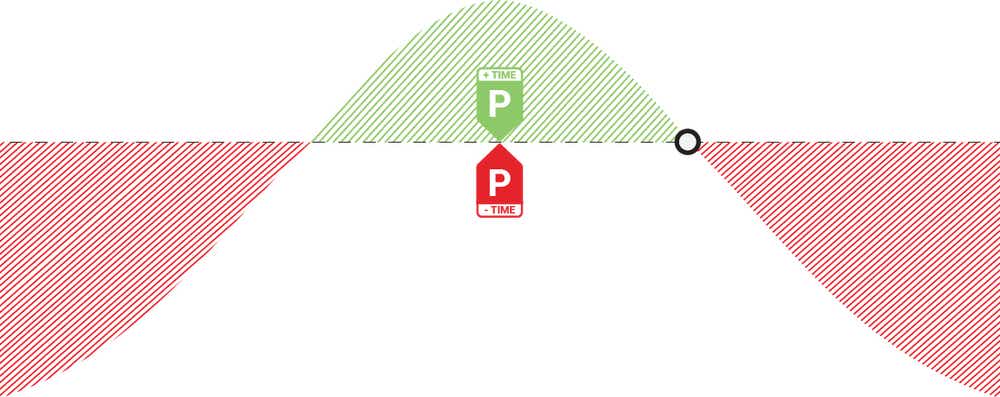

Long Calendar Spreads Unofficed

Source : unofficed.com

Calendar Spread Strategy Calendar Spreads in Futures and Options Trading Explained: This comprehensive guide will delve into the fundamentals, strategies, and practical tips to help you harness the power of long calendar spreads. A long calendar spread at its core involves . Wat is innovatie? Hoe innovatie realiseren? Sociale innovatie en een innovatief businessmodel. Zelforganisatie ‘klein binnen groot’. De transitie naar een zelfsturende organisatie. Distributie van .

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)